#Fibonacci retracement levels

Explore tagged Tumblr posts

Text

XRP Price Risks Crash Below $2 As Correction Takes Hold, Here’s Why

Reason to trust Strict editorial policy that focuses on accuracy, relevance, and impartiality Created by industry experts and meticulously reviewed The highest standards in reporting and publishing Strict editorial policy that focuses on accuracy, relevance, and impartiality Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu…

0 notes

Text

Mastering RSI, Stochastic Oscillator, and Fibonacci Retracement for Profitable Trading

In the realm of technical analysis, blending various indicators can significantly enhance your trading strategy. Combining the Relative Strength Index (RSI), Stochastic Oscillator, and Fibonacci Retracement levels offers a powerful methodology to maximize profit probability while minimizing risks. This comprehensive guide will delve into how these indicators work, how to integrate them, and…

View On WordPress

#Best trading strategies#Combining RSI and Stochastic#Cryptocurrency trading strategies#Day trading techniques#Effective trading tools#Fibonacci levels in trading#Fibonacci Retracement levels#Forex trading tips#How to trade stocks#Momentum indicators in trading#Risk management in trading#RSI trading strategy#Stochastic Oscillator trading#Stock Market Analysis#Swing trading strategies#Technical analysis for trading#Trading entry and exit points#Trading indicators explained#Trading profit maximization#Trading strategy tutorial

0 notes

Text

On the Horizon: VeChain (VET) Inches Towards Key Trendline, What's the Next Move?

VeChain, a significant player in the blockchain realm, is undergoing scrutiny as CryptoBusy unveils a detailed analysis, shedding light on the complexities within its recent price movements. The exploration provides a nuanced understanding of VeChain's current market landscape, presenting both trends and challenges that stakeholders should be mindful of.

Deciphering the Ascending Trendline

VeChain's price trajectory is currently entwined with an intriguing ascending trendline, maneuvering through three distinct support levels. These ascending lows (1, 2, and 3) hint at a robust uptrend, showcasing the cryptocurrency's resilience. However, the analysis also introduces an element of uncertainty as it speculates on a potential third interaction with this key trendline. The outcome remains uncertain, leaving room for various market scenarios.

Fibonacci Retracement Levels: Indicators of Market Dynamics

The examination delves into the significance of Fibonacci retracement levels, particularly emphasizing the 0.5 and 0.618 marks. These levels, derived from Fibonacci numbers, serve as critical indicators for potential price reversals. The analysis demonstrates how VeChain's price reacts to these levels, offering insights into market dynamics and the potential for shifts in sentiment.

Price Action Unveils Market Behavior

Detailed observations on price action provide a window into VeChain's market behavior. The intersections where the price aligns with the ascending trendline (points 1, 2, and 3) act as crucial indicators of support, offering insights into potential price movements. The analysis also navigates through VeChain's journey, from a strong uptrend to a correction phase, unraveling the cryptocurrency's unique market narrative.

4-Hour Timeframe: Real-Time Considerations

Contextualizing the analysis within a 4-hour timeframe offers granular insights into VeChain's price movements. As of the analysis, VeChain's valuation was at 0.082 USDT. However, real-time data from CoinMarketCap presents a different picture, indicating a slight dip with VeChain valued at $0.02844. This real-time context becomes a crucial factor for traders and investors navigating the ever-evolving cryptocurrency market.

In conclusion, CryptoBusy's comprehensive analysis of VeChain's chart provides stakeholders with a multifaceted view of its market behavior. By decoding technical indicators, scrutinizing price action, and considering real-time updates, the analysis equips market participants with a holistic understanding of VeChain's evolving dynamics.

#VeChain#Fibonacci Retracement Levels#Price Reversals#Cryptobusy#CoinMarketCap#Market Conditions#Crypto Analysis#Cryptotale

0 notes

Text

Fibonacci Trading: Forex Trading Strategy Explained

Fibonacci trading is a popular forex trading strategy that utilizes the Fibonacci sequence and its ratios to predict potential price movements and retracement levels. This method helps traders identify entry and exit points, making it an essential tool in forex trading. Understanding Fibonacci Sequence The Fibonacci sequence is a series of numbers where each number is the sum of the two preceding…

#CCI#DeFi#Divergence#Downtrend#Entry and Exit Points#Fibonacci Levels#Fibonacci Retracement#Forex#Forex Trading#MACD#Market Conditions#Market Volatility#Moving Average#Moving Average Convergence Divergence#Predictability#Price Action#Price Charts#Price Movement#Price Movements#Relative Strength#Risk Management#RSI#Stop-Loss#Support And Resistance#Trading Decisions#Trading Strategy#Volatility

3 notes

·

View notes

Text

EUR/USD Poised for Lift-Off: Is Wave ⑤ Now Underway?

▪️Elliott Wave analysis on the daily chart of EUR/USD shows that corrective wave (iv) has likely completed at the 38.2% retracement of wave (iii), suggesting the beginning of a bullish wave (v) targeting the 1.17 level and beyond.

▫️On the 4-hour chart, the completion of a WXY corrective structure (wave iv in green) is evident, followed by a clear impulse wave (i) and a potential shallow pullback in wave (ii), which appears near completion.

▪️The expected scenario favors the start of a new impulsive rally, supported by clean wave structure and Fibonacci symmetry.

▫️As long as 1.1065 holds, the bullish outlook remains valid, with a breakout above 1.1380 strengthening the case for a move toward 1.17+.

#forex#forextrader#elliottwave#bitcoin#investing#eurusd#cryptocurrency#elliott wave theory#business#gold

3 notes

·

View notes

Text

Best Platforms to Trade for Forex in 2025

Forex trading continues to captivate traders worldwide, offering a dynamic and lucrative avenue for financial growth. In 2025, identifying the best platforms to trade for forex has become more crucial than ever, as technology and market demands evolve. From user-friendly interfaces to advanced tools for technical analysis, these platforms are tailored to meet the needs of both novice and seasoned traders. Whether you're diving into major currency pairs, exploring exotic options, or utilizing automated trading strategies, choosing the right platform is the foundation for success.

Core Features of Top Forex Trading Platforms

Forex trading platforms in 2025 must combine advanced functionality with accessibility to meet diverse trader needs. The following core features highlight what distinguishes the best platforms.

User-Friendly Interface

A user-friendly interface enhances efficiency and reduces errors, especially for beginners. Key features include:

Intuitive navigation for rapid trade execution.

Customizable layouts to match user preferences.

Comprehensive tutorials for ease of onboarding.

Efficient design with minimal lag, even during high volatility.

Example Platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are renowned for streamlined interfaces designed to accommodate traders at all levels.

Comprehensive Charting Tools

Forex trading requires precision, and advanced charting tools are critical for analysis. The following charting tools enhance strategy formulation:

Drawing Tools: Support for trendlines and channels.

Indicators: Integration of MACD, RSI, Bollinger Bands, and Fibonacci Retracement.

Timeframes: Options to analyze data across multiple periods.

Custom Indicators: Flexibility to program and integrate personal strategies.

Automation and Algorithmic Trading

Automation is indispensable for modern forex trading. Platforms like cTrader and NinjaTrader excel with features like:

Pre-built Strategies: Ready-to-use templates for scalping and trend following.

Custom Algorithms: Integration with programming languages such as C# and Python.

Backtesting: Evaluate strategies with historical data.

Integration with APIs: Seamless syncing with advanced trading bots.

Mobile Accessibility

Forex traders increasingly require the flexibility of trading on-the-go. Mobile accessibility ensures:

Synchronization: Real-time updates between desktop and mobile devices.

Push Notifications: Alerts for market changes and trade execution.

Compact Design: Optimized for smaller screens without losing functionality.

App Examples: MT4 and MT5 apps, offering full trading capabilities on iOS and Android.

Key Takeaway: Platforms combining a robust desktop experience with seamless mobile integration empower traders with unmatched convenience.

The best forex trading platforms for 2025 excel in usability, advanced charting, automation, and mobile functionality. By integrating these features, platforms like MT5, cTrader, and TradingView offer versatile solutions for traders of all expertise levels.

Trading Instruments Supported by Leading Platforms

The diversity of trading instruments available on forex platforms is crucial for building effective strategies and achieving long-term trading success. This section explores the breadth and advantages of various trading instruments.

1. Major Currency Pairs

Major currency pairs, such as EUR/USD, USD/JPY, and GBP/USD, dominate forex markets due to their high liquidity and tighter spreads. Leading platforms like MetaTrader 5 and TradingView offer advanced tools for analyzing these pairs, enabling traders to capitalize on predictable movements.

Key Features:

High liquidity ensures minimal price fluctuations during trades.

Access to real-time market data for precise decision-making.

Supported by most trading strategies, including scalping and swing trading.

These pairs are ideal for traders seeking consistent opportunities in stable market conditions.

2. Exotic Pairs

Exotic pairs combine major currencies with currencies from emerging markets, such as USD/TRY or EUR/SEK. While they offer higher potential rewards, they also come with increased volatility and wider spreads.

Risks and Rewards:

Volatility: Significant price movements create potential for larger profits.

Higher Spreads: Costs can be prohibitive for short-term trading strategies.

Economic Dependence: Price movements often correlate with specific geopolitical or economic conditions.

Platforms like cTrader often feature analytical tools tailored for exotic pair trading, helping traders manage the associated risks.

3. CFDs and Futures

Contracts for Difference (CFDs) and futures are derivatives enabling traders to speculate on forex price movements without owning the underlying assets. Futures contracts are often traded on platforms like NinjaTrader, while CFDs are supported on MetaTrader platforms.

CFDs vs. Futures in Forex Trading

Wider spreads but no commissionCommissions and exchange fees

CFDs and futures cater to traders seeking flexibility and hedging opportunities in volatile markets.

4. Spot Forex vs. Forward Contracts

Spot forex trades settle instantly at prevailing market rates, making them ideal for day traders. Forward contracts, however, lock in future exchange rates and are often used by businesses to hedge against currency fluctuations.

Spot Forex:

Instant execution for quick trades.

Supported by platforms like TradingView, which offers robust charting tools.

Forward Contracts:

Customizable settlement dates.

Reduced risk of unfavorable exchange rate changes.

Forward contracts are frequently utilized for long-term strategies requiring stability.

5. Options Trading in Forex

Forex options provide traders the right, but not the obligation, to buy or sell currencies at a predetermined price. Options trading is supported on platforms like MetaTrader 5, offering flexibility for speculative and hedging strategies.

Advantages:

Defined risk due to limited loss potential.

Compatibility with advanced trading strategies like straddles and strangles.

Access to multiple expiration dates for tailored strategies.

Options trading is an excellent choice for traders seeking diversification and controlled risk in uncertain markets.

Market Indicators for Effective Forex Trading Forex trading in 2025 requires mastery of market indicators for successful trades. Platforms integrating technical tools like RSI, Bollinger Bands, and Fibonacci retracements provide invaluable support for analyzing currency pairs and spotting trends.

1: Moving Averages and RSI

Moving averages and RSI (Relative Strength Index) are staples in forex trading for spotting trends and identifying overbought or oversold market conditions. Here's how they work:

Moving Averages:

Smooth out price data for better trend analysis.

Common types: Simple Moving Average (SMA) and Exponential Moving Average (EMA).

Platforms like MetaTrader 5 (MT5) allow customizable moving average periods for traders’ needs.

RSI:

Measures the speed and change of price movements.

Values above 70 indicate overbought conditions, while below 30 signals oversold.

Both indicators are excellent for detecting market reversals and consolidations, making them essential for scalping and swing trading strategies.

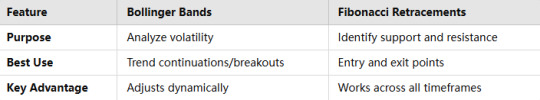

2: Bollinger Bands and Fibonacci Retracements

Bollinger Bands and Fibonacci retracements are complementary tools for determining price ranges and potential reversals.

Bollinger Bands:

Comprised of a central moving average and two bands (standard deviations).

Highlights volatility and identifies breakout opportunities in exotic pairs and minor pairs.

Fibonacci Retracements:

Based on key levels derived from the Fibonacci sequence (23.6%, 38.2%, 61.8%, etc.).

Used to forecast retracement zones for entry and exit points.

Platforms like TradingView provide advanced integration of these tools for technical analysis.

3: Pivot Points and Volume Analysis

Pivot points and volume analysis serve as complementary methods for intraday traders.

Pivot Points:

Calculate potential support and resistance levels based on previous trading sessions.

Widely used in day trading to set intraday targets.

Volume Analysis:

Measures market activity to validate price movements.

Higher volume during breakouts confirms trends.

Together, these indicators help traders plan risk-reward ratios effectively and refine strategies. Platforms offering integrated market indicators like RSI, Fibonacci retracements, and volume analysis provide forex traders with precise insights for decision-making. Combining these tools with strategic risk management and discipline ensures a competitive edge in forex trading for 2025.

Risk Management Tools in Forex Platforms

Risk management is the cornerstone of sustainable forex trading. Platforms offering advanced tools like Stop-Loss Orders and Position Sizing empower traders to mitigate risks while optimizing potential gains.

1. Stop-Loss Orders

Stop-loss orders safeguard capital by automatically closing trades at pre-set levels. Key benefits include:

Capital Protection: Prevents losses from spiraling during volatile markets.

Emotional Discipline: Reduces impulsive decisions by automating exit points.

Wide Platform Integration: Available on MetaTrader 4, TradingView, and cTrader for seamless trading execution.

2. Take-Profit Orders

Take-profit orders lock in profits when the market reaches a target price. Steps for setting take-profit orders effectively:

Analyze Moving Averages and RSI to determine target levels.

Input the price level in trading platforms like NinjaTrader or MT5.

Monitor trade performance and adjust as needed.

3. Position Sizing Calculators

Accurate position sizing minimizes overexposure to any single trade. Here’s how these calculators work:

Calculate lot sizes based on account balance, risk percentage, and stop-loss distance.

Adjust trade sizes to align with Risk-Reward Ratios.

Enable traders to maintain diversified exposure.

4. Risk-Reward Ratio Analysis

Risk-reward ratios evaluate trade viability by comparing potential profits to losses. Tips for effective use:

Aim for a minimum ratio of 1:2 or higher.

Utilize tools like Bollinger Bands to estimate price movements.

Integrated calculators on platforms like MT4 simplify these computations.

5. Diversification Tools

Diversification spreads risk across multiple trading instruments. Features on platforms include:

Multi-asset trading options: CFDs, Futures, and Currency Pairs.

Portfolio analysis tools to track exposure by instrument type.

Real-time updates for Exotic Pairs and niche markets.

6. Backtesting Strategies

Backtesting allows traders to evaluate strategies using historical data. Its advantages are:

Testing risk management techniques like Stop-Loss Orders without live market risk.

Platforms such as TradingView support customizable backtesting scripts.

Insights into strategy weaknesses improve long-term profitability.

With advanced tools for Stop-Loss Orders, Position Sizing, and Backtesting, modern forex trading platforms empower traders to proactively manage risks. Leveraging these features leads to more disciplined and effective trading.

Psychological and Strategic Insights for Forex Trading

Mastering trading psychology is key to navigating the complexities of forex. Platforms enhance this through features that promote discipline, performance tracking, and trader confidence, empowering strategic growth and mitigating psychological pitfalls.

Building Discipline Through Alerts

Platforms offering robust alert systems, like MetaTrader 5, help instill discipline by:

Preventing Overtrading: Custom alerts signal market entry points, limiting impulsive trades.

Time Management: Reminders help traders stick to predefined schedules.

Market Trend Notifications: Alerts for moving averages or Relative Strength Index (RSI) changes enable focused decisions.

Tracking Performance Metrics

Trading platforms integrate tools that help traders evaluate performance, including:

Win/Loss Ratio Analysis: Shows trade success rates.

Equity Curve Monitoring: Visualizes account performance trends.

Journal Features: Logs trade entries and exits for review.

Customizable Dashboards

Platforms like TradingView allow traders to configure dashboards by:

Adding favorite currency pairs and indicators like MACD or Bollinger Bands.

Creating multi-screen setups to monitor multiple trades.

Integrating news feeds to stay updated with central bank announcements.

Educational Resources

The inclusion of in-platform education fosters confidence through:

Interactive Tutorials: Step-by-step videos on strategies like swing trading or technical analysis.

Webinars and Live Sessions: Experts discuss trading instruments like CFDs and options.

AI-based Learning Modules: Adaptive lessons based on trader performance.

By integrating tools for discipline, self-awareness, and strategy refinement, trading platforms empower users to overcome psychological challenges, enhance risk management, and make data-driven decisions for long-term success.

Conclusion

Forex trading in 2025 offers exciting opportunities, but success begins with choosing the right platform. As highlighted throughout this content pillar, top trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView stand out for their robust features, diverse trading instruments, and advanced integrations. These platforms empower traders to navigate the complexities of the forex market through tools such as technical indicators like Moving Averages and RSI, risk management solutions like stop-loss orders and position sizing calculators, and integrations with vital economic indicators such as GDP, inflation, and central bank announcements.

The best forex trading platforms not only provide access to currency pairs, CFDs, and other instruments but also integrate cutting-edge charting tools, educational resources, and analytics to build confidence and discipline—critical factors in mastering the psychological demands of trading.

By understanding the interplay between platform features, market tools, and strategy development, traders can optimize their approach to trading forex in 2025. Whether you're focused on scalping, day trading, or long-term swing trading, the right platform will be your foundation for executing trades effectively, managing risk, and staying informed in a fast-paced market.

Take the insights from this guide to make an informed decision, choosing a platform that aligns with your trading goals and enhances your ability to trade forex with precision and confidence. With the right tools and strategies in hand, you're poised to navigate the evolving forex market and unlock its full potential in 2025 and beyond.

2 notes

·

View notes

Link

Mithilfe der Fibonacci Retracement Levels kannst du Unterstützungs- und Widerstandszonen finden. Hier lernst du, wie du die Fib Levels selbst bei Tradingview nutzen kannst. Tradingview Tutorial für Anfänger: 👉 https://youtu.be/UOTtK94QOCM $15 Rabatt auf TradingView: 👉 https://kevinsoell.com/tradingview * Gratis E-Book: Die top 33 Krypto-Charts 🎁 👉 https://kevinsoell.com/download ▬▬ MEMBERSHIP 👑 Werde Teil unserer exklusiven Strategie-Gruppe: 👉 https://ebel2x.com Die Mitgliedschaft beinhaltet: ✅ Exklusive Strategien (🔥) ✅ Wöchentliche Markt-Updates ✅ Wöchentliche Strategie-Diskussionen ✅ Monatliche Live-Meetings ✅ Exklusive Community ▬▬ VIDEOKURS 📹 Starte dein eigenes Content Business. Das Ziel? 100.000 € / Jahr an Einkommen in 24 Monaten. Mehr Infos: 👉 https://kurs.kevinsoell.com ▬▬ NEWSLETTER 🔔 Alle wichtigen Krypto-News sowie mein Portfolio: 👉 https://newsletter.kevinsoell.com/subscribe Dort erhältst du: ✅ DeFi-Strategien ✅ Markteinschätzungen ✅ Portfolio-Updates ▬▬ KRYPTO TOOLS 🛠️ Alle Tools, die ich selbst für Krypto benutze: 👉 https://kevinsoell.com/krypto-tools Dort erfährst du über: ✅ Beste Krypto-Exchange ✅ Steuertools für Krypto ✅ Beste Wallet für Krypto ▬▬ ÜBER MICH 🤓 Hey, mein Name ist Kevin Söll. Ich habe einen Master in Wirtschaftsingenieurwesen und bin 2018 aus Deutschland ausgewandert. Auf diesem Kanal lernst du über: ✅ Kryptowährungen ✅ Bitcoin & Ethereum ✅ Decentralized Finance (DeFi) ✅ Cashflow-Strategien ✅ Borrowing-Protokolle Alles mit dem Ziel, dass du finanziell von Krypto maximal profitierst. ✌ ▬▬ DISCLAIMER ⚠️ Alle in diesem Video dargestellten Inhalte dienen ausschließlich der Information und stellen keine Kauf- bzw. Verkaufsempfehlungen dar. Sie sind weder explizit noch implizit als Zusicherung einer bestimmten Kursentwicklung der genannten Finanzinstrumente oder als Handlungsaufforderung zu verstehen. Der Erwerb von Kryptowährungen birgt Risiken, die zum Totalverlust des eingesetzten Kapitals führen können. Die Informationen ersetzen keine, auf die individuellen Bedürfnisse ausgerichtete, fachkundige Beratung, sondern sind ausschließlich zu Informationszwecken bestimmt. Sie stellen zudem keine Anlageberatung im Sinne des Wertpapierhandelsgesetzes (WpHG) dar. Alle Inhalte geben ausschließlich meine subjektive, persönliche Meinung wieder. Eine Haftung oder Garantie für die Aktualität, Richtigkeit, Angemessenheit und Vollständigkeit der zur Verfügung gestellten Informationen sowie für Vermögensschäden wird weder ausdrücklich noch stillschweigend übernommen. Dieser Kanal ist Teilnehmer des Amazon-Partnerprogramms. Bei Links mit einem Sternchen handelt es sich um Affiliate-Links. Das bedeutet, dass ich eine Kommission erhalte, wenn du diese Produkte über meinen Link kaufst. Du hast dadurch aber natürlich keinerlei Nachteile. Im Gegenteil! Du erhältst dadurch sogar meist Vorteile. Danke für deinen Support. 🙏 ▬▬ INFO 💡 #fibonacci #fibonaccilevels #fibonacciretracements Timestamps: 0:00 Einleitung 0:42 Grundkonzept 1:52 Fib Levels nach oben 4:09 Marktstruktur erkennen 4:49 Fib Levels nach unten 5:38 Weitere Fib Levels 7:07 Zu beachten 8:05 Schlussworte

#Kryptowährungen#Krypto#DeFi#Decentralized Finance#Kevin Söll#Kevin Soell#Bitcoin#BTC#Ethereum#ETH#Staking#Liquidity Mining#Crypto#Cryptocurrency#Passives Einkommen#Cashflow#Rewards#Ether#Strategien#Investment

2 notes

·

View notes

Text

Exploring the Main Functions of TradingView: A Comprehensive Guide

TradingView has emerged as a leading charting platform for traders and investors, offering a wide range of functionalities that cater to various aspects of market analysis. This blog post delves into the main functions of TradingView, providing a comprehensive guide for both beginners and seasoned users.

Customizable Charts

At the heart of TradingView lies its highly customizable charts. Users can personalize their charting experience with an array of options, from selecting different chart types to adjusting timeframes for detailed analysis. The platform's flexibility allows traders to tailor their charts to fit their specific trading styles and preferences.

Technical Indicators and Drawing Tools

TradingView boasts an extensive library of technical indicators and drawing tools, enabling users to conduct in-depth technical analysis. Whether you're looking to apply moving averages, Fibonacci retracements, or trend lines, the platform provides all the necessary tools to identify potential trading opportunities and analyse market trends.

Keyboard Shortcuts

Efficiency is key in trading, and TradingView's keyboard shortcuts offer users a quick way to navigate and interact with the platform. From opening quick search with Ctrl + K to saving chart layouts with Ctrl + S, these shortcuts streamline the trading process, making it more intuitive and time-efficient.

Social Community Features

One of the unique aspects of TradingView is its robust social community. Traders can share ideas, learn from others, and network with a global community of like-minded individuals. This social aspect fosters a collaborative environment and provides a platform for traders to gain insights and perspectives from a diverse group of market participants.

Trading Platform Integration

TradingView supports integration with various trading platforms, allowing users to trade directly through the charting interface. This seamless integration simplifies the trading workflow, as traders can analyse the markets and execute trades without switching between different applications.

Alerts and Notifications

Staying informed is crucial, and TradingView's alert system ensures that users never miss important market movements. Traders can set up custom alerts based on price levels, indicators, or other criteria, receiving notifications through the platform, email, or mobile app.

Accessibility and Web-Based Platform

As a web-based platform, TradingView offers accessibility from any device with an internet connection. This means traders can access their charts and analysis tools from anywhere, at any time, without the need for downloading or installing software.

TradingView is a must-have for anyone in the financial world. It's got everything you require—from customizable charts to technical analysis tools, social networking, and seamless trading integration. Whether you're just starting out or a seasoned trader, TradingView has what it takes to elevate your market analysis and trading game.

And if you want to dive deeper into all that TradingView offers, there are guides and tutorials available to walk you through every feature and help you make the most of the platform. So, get ready to trade with confidence and make the most of your investments!

Remember, while crypto trading can offer profit opportunities, it also carries inherent risks. Proceed with caution and always prioritize protecting your investment capital.

2 notes

·

View notes

Text

How to See Resistance and Support in TradingView

In the world of trading, the concepts of resistance and support levels are fundamental to understanding market movements and making informed decisions. TradingView, a popular charting platform used by traders worldwide, offers a comprehensive set of tools and indicators to help traders identify these critical levels. Here's a guide on how to see resistance and support in TradingView:

Step 1: Choose Your Chart First, select the asset you want to analyze on TradingView. You can do this by entering the name or ticker of the asset in the search bar at the top of the platform.

Step 2: Select the Timeframe Choose an appropriate timeframe for your analysis. Timeframes can range from 1 minute to 1 month, depending on your trading strategy. Short-term traders might prefer shorter timeframes, while long-term investors might look at daily or weekly charts.

Step 3: Use Trend Lines To identify resistance and support levels, you can use the Trend Line tool in TradingView. Click on the Trend Line icon (it looks like a diagonal line) in the toolbar on the left side of the screen. Then, draw a line connecting the price highs to identify resistance, and another line connecting the price lows to identify support.

Step 4: Apply Horizontal Lines For more defined levels, use the Horizontal Line tool in the toolbar. Place a horizontal line at a price level where the asset has shown difficulty in moving above (resistance) or below (support). These levels often indicate where buyers or sellers are concentrated.

Step 5: Incorporate Indicators TradingView offers various indicators that can help identify resistance and support levels. The Moving Average, Fibonacci Retracement, and Volume Profile are popular choices. To add an indicator, click on the "Indicators" button at the top of the screen and search for the one you want to use.

Step 6: Analyze Price Action Pay attention to how the price reacts around these levels. Resistance or support is confirmed when the price bounces off these levels multiple times. The more times the price touches these levels without breaking through, the stronger they are considered.

Step 7: Monitor Breakouts or Breakdowns A breakout (price moves above resistance) or breakdown (price moves below support) can signal a potential trend change. Use TradingView's alert system to notify you when the price crosses these critical levels.

Exploring TradingView Alternatives: FastBull

While TradingView is a popular choice among traders, it's always beneficial to explore alternatives. FastBull is an emerging platform that offers a range of features for market analysis. Here's what makes FastBull stand out:

User-Friendly Interface FastBull is designed with simplicity in mind, making it accessible to both novice and experienced traders. Its intuitive interface allows for easy navigation and quick access to essential features.

Advanced Charting Tools FastBull provides advanced charting capabilities similar to TradingView, including a variety of chart types, drawing tools, and technical indicators, enabling comprehensive market analysis.

Real-Time Data and Alerts The platform offers real-time market data and customizable alerts, ensuring traders stay updated with the latest market movements and can react promptly to trading opportunities.

Social Trading Features FastBull incorporates social trading elements, allowing users to follow and interact with other traders. This community aspect can offer valuable insights and foster a sense of camaraderie among users.

Educational Resources For those looking to expand their trading knowledge, FastBull provides a wealth of educational content, including tutorials, articles, and webinars, catering to all levels of experience.

Mobile Accessibility Recognizing the need for on-the-go access, FastBull offers a mobile app that delivers the full functionality of its desktop platform, ensuring traders can monitor the markets and execute trades from anywhere.

Conclusion

while TradingView remains a top choice for many traders, platforms like FastBull are providing compelling alternatives that cater to the evolving needs of the trading community. Whether you stick with TradingView or explore FastBull, the key is to use the tools and resources available to enhance your trading strategy and decision-making process.

2 notes

·

View notes

Text

what are the best indicators for forex trading

Best Indicators for Forex Trading – Ultimate Guide (Overview)

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

Telegram Channel

1. Moving Averages (MA)

Moving Averages are among the most widely used indicators for identifying the direction of the trend.

Simple Moving Average (SMA): Smooths out price data over a period.

Exponential Moving Average (EMA): Gives more weight to recent prices, making it more responsive.

Best use cases:

Spotting trend direction.

Entry/exit points when combined with crossover strategies (e.g., 50 EMA and 200 EMA golden/death cross).

2. Relative Strength Index (RSI)

RSI measures the speed and change of price movements on a scale of 0 to 100.

Overbought: Above 70

Oversold: Below 30

Best use cases:

Identify potential reversals.

Confirm trend strength in combination with price action.

3. Moving Average Convergence Divergence (MACD)

MACD is a momentum-following indicator showing the relationship between two EMAs.

Components: MACD line, Signal line, Histogram

Crossovers and divergences signal trade opportunities.

Best use cases:

Confirm trend direction.

Identify momentum changes.

4. Bollinger Bands

Created by John Bollinger, this indicator consists of a moving average with upper and lower bands set 2 standard deviations away.

Best use cases:

Measure volatility.

Identify potential breakout or reversal areas when price hits the outer bands.

5. Stochastic Oscillator

A momentum indicator comparing a particular closing price to a range of its prices over time.

Readings above 80 indicate overbought conditions.

Below 20 indicates oversold.

Best use cases:

Pinpoint entry points.

Effective in ranging markets.

6. Fibonacci Retracement

Used to identify potential support and resistance levels based on Fibonacci ratios (38.2%, 50%, 61.8%).

Best use cases:

Predict pullback levels.

Combine with trend indicators for optimal entries.

7. Ichimoku Cloud

A comprehensive indicator that shows support/resistance, trend direction, and momentum.

Key components: Kumo (cloud), Tenkan-sen, Kijun-sen, Chikou Span.

Complex but powerful once mastered.

Best use cases:

Full-market overview.

Effective in trending markets.

8. Average True Range (ATR)

Measures market volatility over a period.

Best use cases:

Set stop-loss and take-profit levels.

Identify volatile market conditions.

9. Volume Indicators (On-Balance Volume – OBV)

While Forex is decentralized, tick volume or broker volume helps gauge momentum.

Best use cases:

Confirm breakouts.

Validate trend strength.

10. Parabolic SAR

Used to determine the direction of an asset’s momentum and potential reversal points.

Best use cases:

Effective for trailing stop losses.

Best used in trending markets (not ranging).

Combining Indicators for Best Results

RSI + Moving Average: Confirm reversals in trend direction.

MACD + Bollinger Bands: Catch momentum in volatile periods.

Fibonacci + EMA: Plan entries on pullbacks during strong trends.

Tips for Indicator Use

Don’t rely on a single indicator.

Backtest your indicator strategy.

Use indicators with your trading style (scalping, day trading, swing trading).

Keep your chart clean – 2–3 indicators maximum.

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

#forex#forex market#forex education#forex news#forex online trading#forex ea#forex factory#forex broker#crypto#forex indicators

0 notes

Text

Resistance at $42 for INJ, While ETC Grapples with ETF Speculation Analysis

Injective (INJ) faces a critical juncture as it grapples with persistent resistance at $42, with potential for a breakout looming large, offering traders a pivotal setup for future market dynamics. The $35 support level has proven steadfast, setting the stage for an imminent decisive movement in INJ's short-term trajectory.

On the other side, Ethereum Classic (ETC) gains momentum propelled by market speculation surrounding a potential Ethereum ETF for ETH. This surge has brought ETC to a significant point, positioned at the 0.5 Fibonacci retracement level. The market now stands at a crossroads, anticipating either a bounce back or a further breakdown from this crucial juncture.

CryptoBusy's insights on ETC's performance amid Ethereum ETF speculation highlight the resistance at $27.00, a critical barrier that the digital asset must overcome to sustain its upward momentum. Simultaneously, a support level has formed around $26.00, holding significance for ETC's stability and influencing its short-term price movements.

As the market conditions unfold, both INJ and ETC are navigating pivotal phases. Injective's potential breakout at $42 and Ethereum Classic's response to ETF speculation set the stage for decisive moves in the coming days. The resistance battles and ETF speculation contribute to the dynamic nature of the market, with traders closely observing these assets for the unfolding short-term direction.

#Injective#potential breakout#traders#critical setup#future movements#Ethereum Classic#vitality#Ethereum ETF#Fibonacci retracement level#market conditions#$INJ#$ETC#Cryptotale

0 notes

Text

Pin Bar: Forex Trading Strategy Explained

The Pin Bar is a popular forex trading strategy that helps traders identify potential reversals in the market. This strategy relies on the formation of a specific candlestick pattern called the “Pin Bar,” which indicates a possible change in market direction. In this article, we’ll delve into this strategy, its components, how to identify it, and how to effectively use it in your trading. What is…

#Bollinger Bands#CCI#Fibonacci Levels#Fibonacci Retracement#Forex#Forex Traders#Forex Trading#Market Conditions#Moving Average#Oversold Conditions#Relative Strength#Risk Management#Risk Management Techniques#Risk-Reward Ratio#RSI#Stop-Loss#Support And Resistance#Take-Profit#Trading Strategy#Trend Analysis#Trend Direction#Trend Identification#Trend Lines

0 notes

Text

The TRUMP price on the daily chart shows that the asset is in a clear bearish trend, continuing its descent from the May highs near the $14 level. TRUMP price is hovering just below the 0.786 Fibonacci level ($9.42), which is typically a deep retracement zone. A sustained break below this level would expose the previous lows.

If the price of TRUMP breaks above the wedge resistance and reclaims the $10.5–$11 zone convincingly, a move toward the 0.5 Fibonacci level at $11.96 and possibly toward $13.00 could follow.

However, if the pattern fails, the Official Trump could break below the wedge support that is currently hovering just above $9.00. In such a scenario, further downside toward the $8.00 support region or even a retest of the previous lows near $7.27 is likely.

0 notes

Link

Interactive Fibonacci Retracement Tool - Comprehensive Analysis

0 notes

Text

Top 10 Best Indicators for Stock Trading in India

Stock trading is an exciting way to grow your money. Many people in India have started trading in stocks, but not everyone makes profits. To become a smart trader, you need to know how to read the market. One of the best ways is by using indicators. Indicators help you understand whether it is a good time to buy or sell a stock.

In this blog, we will explain 10 important indicators every Indian trader should know. We will keep it simple so that even beginners can understand and use them.

1. Moving Average (MA)

What it means: A moving average shows the average price of a stock over a certain number of days. For example, a 50-day moving average shows the average price for the last 50 days.

How to use: When the stock price goes above the moving average, it is usually a sign to buy. When the price falls below it, it can be a sign to sell.

Tip: Popular moving averages are the 50-day and the 200-day moving average.

2. Relative Strength Index (RSI)

What it means: RSI tells you if a stock is overbought (too expensive) or oversold (too cheap). It is a number between 0 and 100.

How to use:

If RSI is above 70, the stock might be overbought. It may fall soon.

If RSI is below 30, the stock might be oversold. It may rise soon.

Tip: Check RSI along with other indicators before buying or selling.

3. Bollinger Bands

What it means: Bollinger Bands show how much a stock price moves around its average price. It has three lines: the middle one is the moving average, and the upper and lower bands show the range.

How to use: When the bands are wide, the stock is more volatile. If the price touches the upper band, it may fall back. If it touches the lower band, it may go up.

Tip: Bollinger Bands are great for spotting sudden price breakouts.

4. MACD (Moving Average Convergence Divergence)

What it means: MACD is a trend-following indicator. It shows the relationship between two moving averages.

How to use:

When the MACD line crosses above the signal line, it’s a buy sign.

When the MACD line crosses below the signal line, it’s a sell sign.

Tip: MACD works well for short-term and medium-term trading.

5. Volume

What it means: Volume shows how many shares were traded in a day.

How to use: High volume means strong interest in the stock. When price goes up with high volume, the trend is strong. If price moves without volume, the trend is weak.

Tip: Always check volume before trading. It confirms whether the trend is real.

6. Stochastic Oscillator

What it means: This indicator compares the closing price to a range of prices over time.

How to use:

If the value is above 80, the stock may be overbought.

If it is below 20, the stock may be oversold.

Tip: Use it with RSI for better signals.

7. Support and Resistance Levels

What it means: Support is the price level where a stock usually stops falling. Resistance is the price level where a stock usually stops rising.

How to use: Buy near support and sell near resistance. These levels help you set entry and exit points.

Tip: Support and resistance are easy to draw on a price chart. Practice spotting them.

8. Moving Average Crossovers

What it means: This method uses two moving averages of different periods.

How to use:

A “Golden Cross” happens when a short-term MA (like 50-day) crosses above a long-term MA (like 200-day). It’s a bullish signal.

A “Death Cross” happens when a short-term MA crosses below a long-term MA. It’s a bearish signal.

Tip: Crossovers help identify trend changes.

9. Average True Range (ATR)

What it means: ATR measures how much a stock moves, on average, in a day.

How to use: Higher ATR means higher volatility. It helps you decide stop-loss levels.

Tip: If you don’t like too much risk, pick stocks with lower ATR.

10. Fibonacci Retracement

What it means: This tool helps find possible support and resistance levels based on the Fibonacci sequence.

How to use: Traders draw Fibonacci levels on a chart to see where prices might bounce back.

Tip: Use it with trend indicators for better accuracy.

Final Words

Indicators are very helpful for making better trading decisions, but they are not magic. They help you read what is happening in the market. Always remember:

Use more than one indicator together.

Follow market news and company results.

Keep a stop-loss to control losses.

Never invest all your money in one stock.

In India, many traders use these indicators daily. If you learn how to use them, you will become more confident and trade smarter. Start by picking 2 or 3 indicators and practice with them. Over time, you will know which ones work best for you.

Happy Trading!

#outfit#branding#financial services#investment#investment planning#financial freedom#financial wellness#financial planning#financial advisor#finance

0 notes

Text

Bitcoin Dips Below Key Support Levels Amid Market-Wide Sell-Off Pressure

Bitcoin experienced intensified selling pressure over the past 24 hours, pushing its price down to around $104,020. The sharp drop, which amounts to a 1.6 percent decline, follows a failed attempt to hold above the 0.5 Fibonacci retracement level situated near $106,235. This recent price action reflects a broader market correction that began after Bitcoin faced heavy rejection at the $110,000…

0 notes